real estate tax shelter act 1986

View detailed information about property 1986 2nd Pl South Plainfield NJ 07080 including listing details property photos school and neighborhood data and much more. Essentially your income tax rate is lowered with.

/TaxDeductions-caca171ee3394a23b5bdac87ddaeb8c4.jpg)

Rental Property Tax Deductions

Tax Reform Act of 1986 by Cordato Roy E.

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

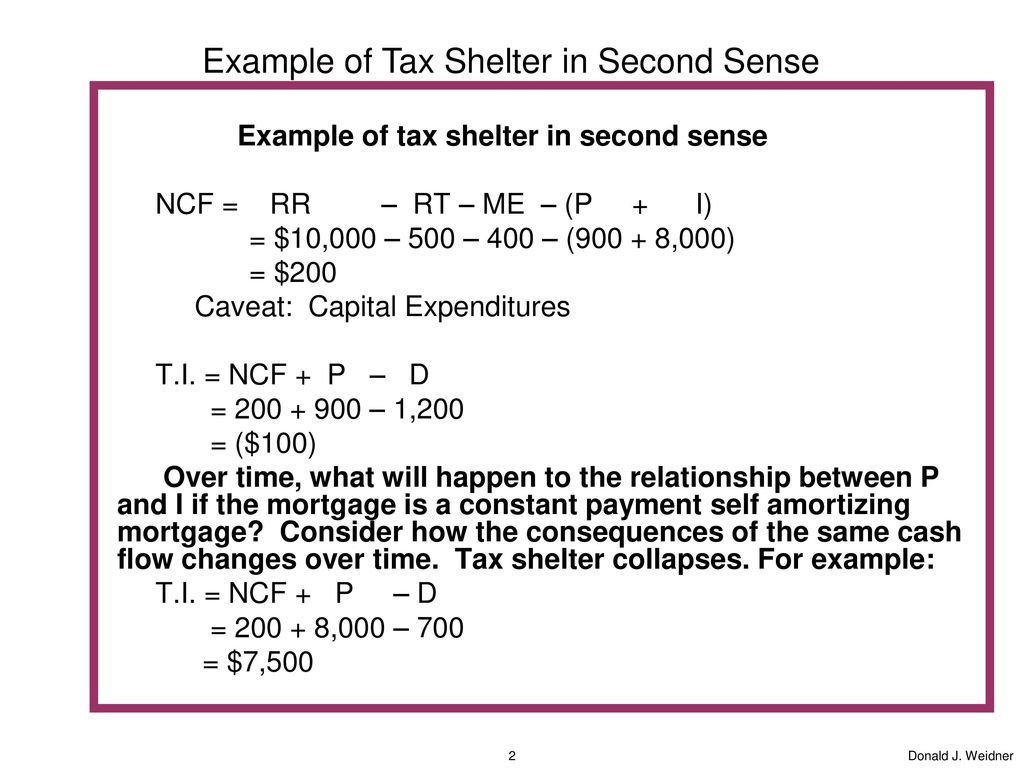

. Unfortunately the Tax Reform Act of 1986 has limited this tax shelter. All real estate losses are considered passive losses losses that are incurred through an enterprise which the investor is. The act either altered or eliminated many.

2085 enacted October 22 1986 to simplify the income tax code broaden the tax base and eliminate. 47 1042 made major changes in how income was taxed. THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S.

INTRODUCTION The Tax Reform Act of 19861. The association meets monthly to address real property tax and assessment issues throughout New Jersey. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during.

While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. October 1986 President Reagan signs the Tax Reform Act of 1986. Jersey City New Jersey 07302.

Congress passed the Tax Reform Act of 1986 TRA PubL. Tax Reform Act of 1986. The Tax Reform Act of 1986 100 Stat.

Education and professional enrichment programs are developed implemented or. Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate. Destroying real estate through the tax code.

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the income tax rate. The 1986 Tax Reform Act has made sweeping changed in the nations tax code. While the Code has been totally revamped the investors of real estate seem to be the main target of the Act.

THE AT-RISK RULES UNDER THE TAX REFORM ACf OF 1986. Among its real estate provisions there are several new rules that prevent taxpayers from using partnerships to. The 1986 Tax Reform Act has made sweeping changed in the nations tax code.

280 Grove Street Room 202. The Liberty Board of REALTORS is concerned that the Jersey City Council has been reacting to. You are eligible for a property tax deduction or a property tax credit only if.

Tax Shelters Floor Fights Deals Negative Reactions Remembering The Dawn Of The Lihtc Novogradac

The 1980s Real Estate Run Up Compared To The Early 2000s Columns Laconiadailysun Com

The Low Income Housing Tax Credit Program Costs More Shelters Less Npr

Dates And Descriptions Of Significant Announcements Concerning The 1976 Download Table

Introduction To Real Estate Tax Shelter Supplement Pages 53 55 Ppt Download

Back To The Future Reagan Trump And Bipartisan Tax Reform

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

Trump S Riches And The Real Estate Tax Racket The American Prospect

Rental Activity Loss Rules For Real Estate Htj Tax

Silicon Valley Residents Say State Death Tax Needs To Die

Real Estate Professional Status A Tax Shelter For Your Day Job The Darwinian Doctor

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

The Incredible Shrinking Estate Tax Tax Policy Center

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

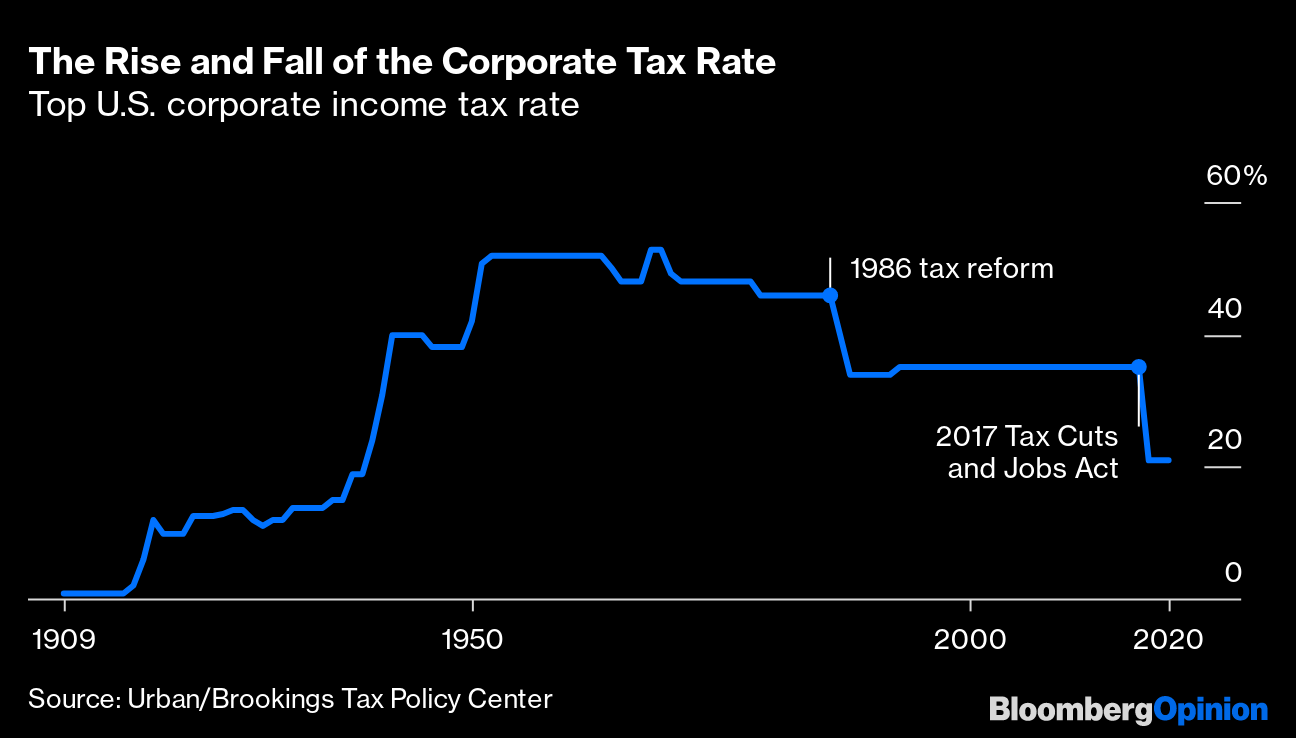

Corporate Income Taxes Have Been Shrinking For Decades Bloomberg

U S Tax Havens Lure Wealthy Foreigners And Tainted Money Washington Post

Tax Shelters Floor Fights Deals Negative Reactions Remembering The Dawn Of The Lihtc Novogradac